Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

India’s premier depository services provider, NSDL, marked its public debut with a 10% premium listing at ₹880 per share on August 6, 2025, compared to its IPO issue price of ₹800. By afternoon trading, the stock saw an uptick of 6% from the listing price, touching intraday highs of ₹932–₹936.

With a reputation for reliability and wide investor base, NSDL’s listing day saw healthy volumes, signaling confidence in its long-term potential—even though it underperformed against its grey market premium (GMP) expectations.

NSDL is a market infrastructure institution, handling over 90% of India’s dematerialized securities. With digitization of financial services, its relevance has only grown.

Key strengths:

While short-term traders may consider partial profit booking, analysts remain bullish for long-term investors due to:

Brokerages like ICICI Securities and Motilal Oswal suggest accumulating on dips.

Real estate player Sri Lotus Developers surprised the street with a sharp debut. Listed at ₹179, nearly 19% higher than its IPO price of ₹150, it rallied further to hit the upper circuit at ₹195.80.

What’s more impressive is that the IPO was subscribed 69 times, with massive support from retail and HNI investors.

The company is known for its luxury residential and commercial projects across South India. Key rally drivers:

The rally reflects bullish sentiment in India’s tier-2 real estate growth story.

M&B Engineering’s IPO received a tepid listing at ₹385–₹386, matching its issue price. However, as trading progressed, investor interest lifted the stock by 9%, closing at ₹418.80.

With a solid order book and focus on infrastructure and EPC projects, the company may gain from India’s ongoing capex cycle.

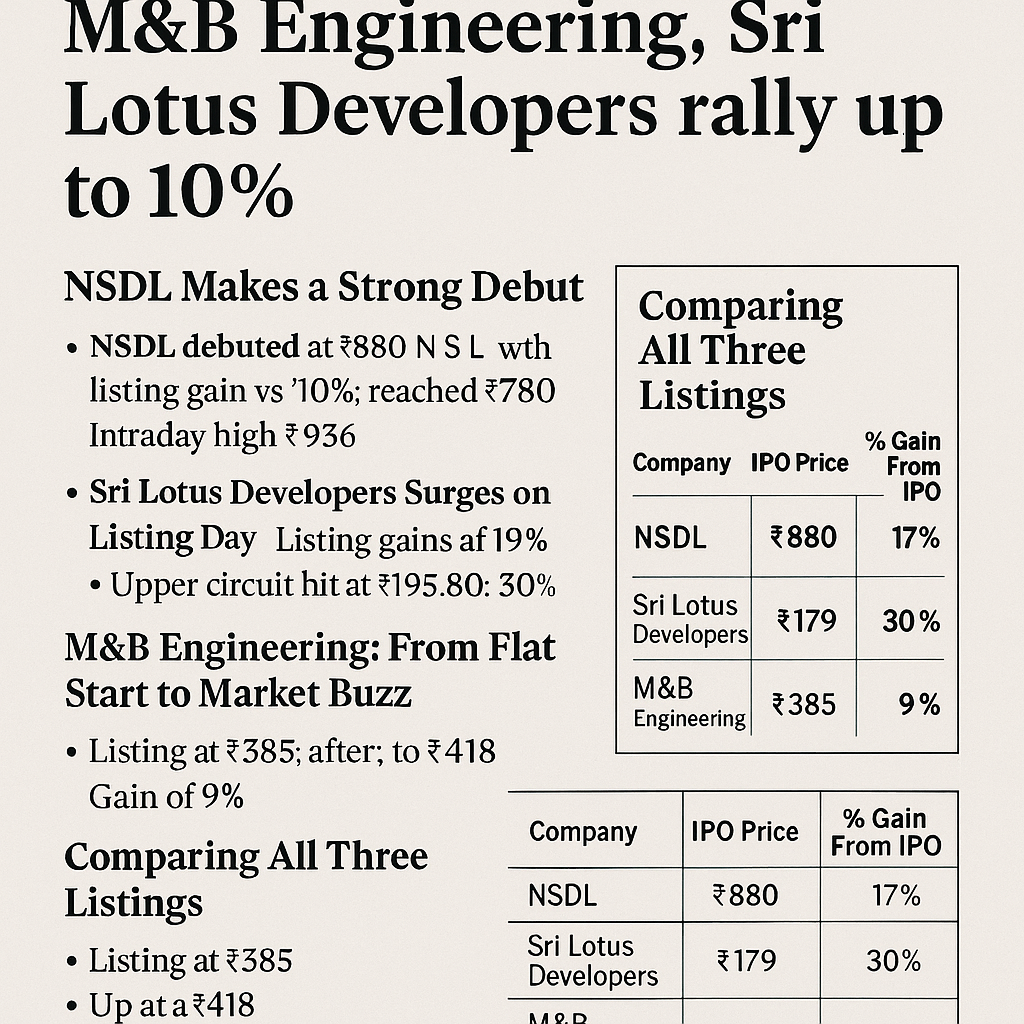

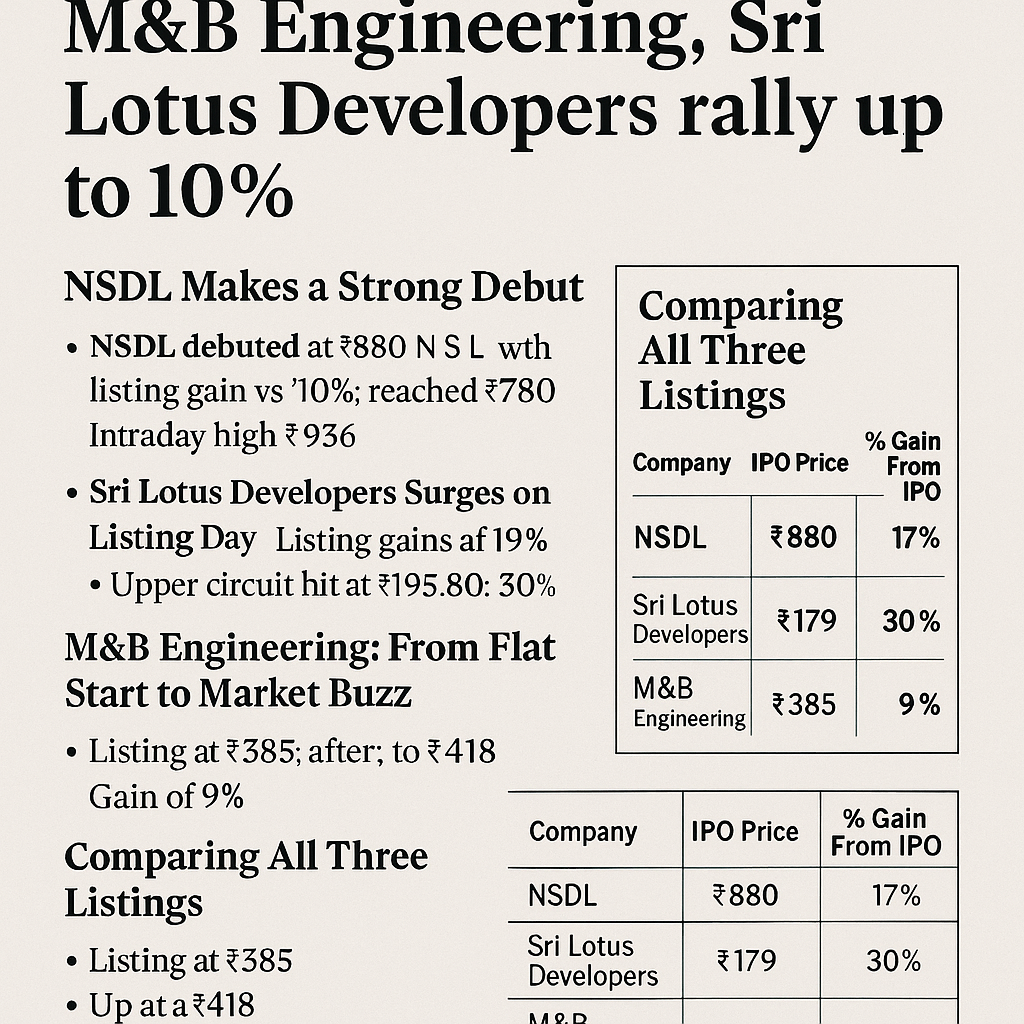

Let’s break down how the three IPOs performed on listing day:

| Company | IPO Price (₹) | Listing Price (₹) | Day High (₹) | % Gain from IPO |

|---|---|---|---|---|

| NSDL | 800 | 880 | 936 | +17% |

| Sri Lotus Developers | 150 | 179 | 195.80 (UC hit) | +30%+ |

| M&B Engineering | 385–386 | 385–386 | 418.80 | +9% |

This table underscores the varied performance based on sector outlook, market mood, and investor expectations. While NSDL and Sri Lotus were clear outperformers, M&B Engineering still made a positive move post-lunch trades.

Market analysts and fund managers are optimistic about the IPO pipeline, citing:

According to Geojit Financial Services, “NSDL’s decent debut is a testament to its strong fundamentals, while real estate’s resurgence is driving interest in names like Sri Lotus.”

Experts recommend:

1. Why did NSDL not hit GMP levels despite a strong listing?

While NSDL had a strong debut, the listing was slightly below the grey market premium due to profit-booking and market-wide consolidation.

2. Is it too late to buy NSDL shares now?

Not necessarily. Analysts suggest long-term investors can enter gradually or wait for dips.

3. What made Sri Lotus Developers stock hit upper circuit?

Strong demand, high oversubscription, and a bullish outlook on the real estate sector drove the stock sharply higher.

4. How did M&B Engineering turn positive after a flat start?

Intraday buying by institutional and retail investors saw it climb 9%, driven by faith in its infrastructure potential.

5. Are more IPOs coming up soon?

Yes. Over 10 IPOs are lined up for the next 2 months across FMCG, fintech, and pharma sectors.

6. Which listing among the three is the best long-term bet?

Analysts favor NSDL for long-term due to its established business and regulatory moat.

The listing success of NSDL, Sri Lotus Developers, and M&B Engineering reflects strong market confidence, sectoral optimism, and India’s vibrant capital market ecosystem.

As investors continue to hunt for alpha, these listings offer insights into market psychology—stability over hype, fundamentals over flash.

Stay tuned as more companies prepare to tap the markets. Until then, diversify smartly and invest wisely